Life Insurance in and around Potomac

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

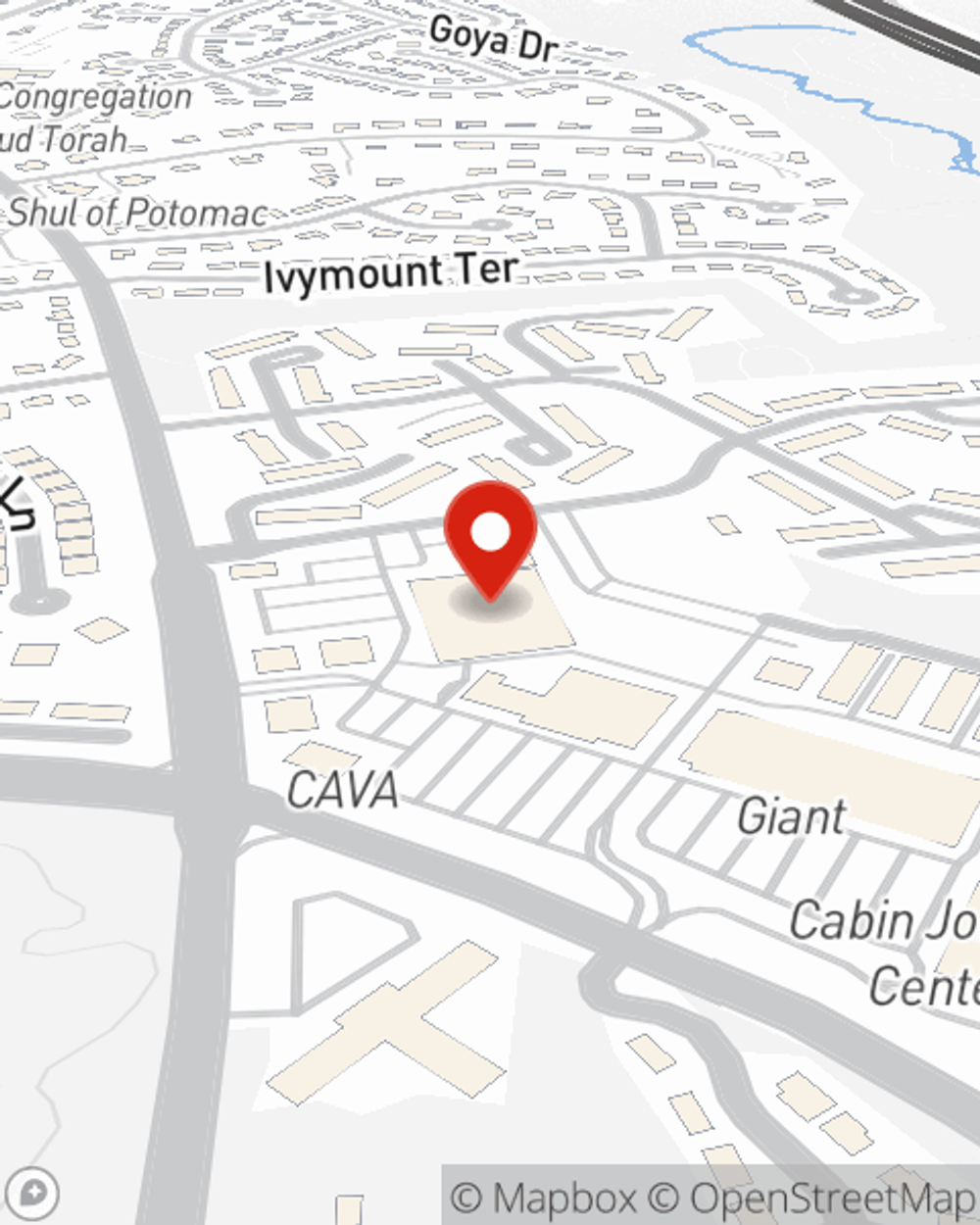

- Potomac

- Potomac, MD

- Rockville

- Rockville, MD

- Poolesville, MD

- Mount Airy, MD

- Howard County

- Silver Spring, MD

- Baltimore, MD

- Hagerstown, MD

- Darnestown, MD

- Travilah, MD

- Bowie, MD

- Gaithesburg, MD

- College Park, MD

- Stafford County, MD

- Anne Arundel, MD

- Loudoun County, MD

- Greenbelt, MD

- District Heights, MD

It's Never Too Soon For Life Insurance

If you are young and just starting out in life, it's the perfect time to talk with State Farm Agent David Munson about life insurance. That's because once you start building a life, you'll want to be ready if tragedy strikes.

Insurance that helps life's moments move on

What are you waiting for?

Their Future Is Safe With State Farm

Coverage from State Farm helps you rest easy knowing your loved ones will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with meeting the needs of children, life insurance is absolutely essential for young families. Even if you or your partner do not have an income, the costs of replacing daycare or before and after school care can be sizeable. For those who don't have children, you may have other family members whom you help financially or have a partner who is unable to work.

Regardless of where you're at in life, you're still a person who could need life insurance. Visit State Farm agent David Munson's office to find out the options that are right for you and the ones you love most.

Have More Questions About Life Insurance?

Call David at (301) 605-7248 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

David Munson

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.